The Ultimate Guide to Accountancy Lead Generation for UK Firms

The Ultimate Guide to Accountancy Lead Generation for UK Firms

Is your accountancy practice stuck in a feast-or-famine cycle when it comes to attracting new clients?

You're not alone. Many UK firms still rely heavily on referrals and outdated marketing tactics and dont have a lead generation system of funnel, leaving their growth to chance. This guide lays out a comprehensive, proven system designed to help accountancy practices across the UK build a predictable and scalable lead generation engine.

Inside, you’ll find practical strategies, real-world case studies, and the specific tools you need to consistently generate qualified leads and keep your pipeline full.

Table of Contents

Why Accountancy Firms Struggle with Lead Generation.

Step 1: Define Your Niche & Ideal Client

Step 2: Optimise Your Online Presence & Local SEO

Step 3: Use Content Marketing & Lead Magnets

Step 4: Run Paid Ad Campaigns (Google & LinkedIn)

Step 5: Referrals, Networking & Partnerships

Step 6: Automate Your Follow-Up & Nurturing

Measuring Success: ROI, CPL, and Conversion Rates

FAQs

Key Takeaways

1. Why Accountancy Firms Struggle with Lead Generation

Many accountancy practices in the UK still depend on word-of-mouth and referrals as their primary source of new business. While referrals can be high quality, they are unpredictable and don't offer the consistency required for sustainable growth.

According to B2B marketing reports, 68% of small service practices struggle with consistent lead generation, and only 24% use marketing automation. Without a reliable system, firms miss out on growth opportunities, suffer from cash flow fluctuations, and are forced into reactive rather than proactive business planning.

By building a structured, strategic lead generation system, firms can gain control over their growth trajectory.

2. Define Your Niche & Ideal Client

One of the most important and often overlooked steps in lead generation is clearly defining your niche and ideal client. Broad messaging rarely converts in today’s crowded market.

Start by choosing a specific industry or demographic that you understand well. For example, you might focus on e-commerce businesses, creative freelancers, or tech startups. Then, create detailed client personas that reflect their unique pain points and goals.

Imagine your ideal client is "Ecom Eddie"—an Amazon seller generating £25k/month who’s overwhelmed by VAT complexities and wants real-time financial dashboards. When your website, emails, and ads speak directly to Eddie’s problems, you’ll immediately stand out.

3. Optimise Your Online Presence & Local SEO

Your website is your digital shopfront—and often the first impression a prospect has of your business. If it’s not built to convert, you’re leaking potential leads.

Use clear, benefit-driven calls to action like “Download Our Free Tax Planning Guide” or “Book a Free 15-Minute Strategy Call”. Ensure that visitors can contact you easily with a lead capture form or chatbot.

To capture local traffic, optimise your site with geographic keywords like “Accountants for freelancers in Birmingham”. Register your firm on Google Business Profile and maintain consistent name, address, and phone number details across all platforms. Encourage clients to leave positive reviews and build location-specific pages to further enhance visibility.

4. Use Content Marketing & Lead Magnets

Content builds trust at scale. By sharing valuable, educational resources, you position your firm as an expert in your niche.

Start with blog posts that answer common client questions, such as “How do I file a VAT return in the UK?” These should be optimised for search engines and include internal links to your services.

Complement your blogs with high-value lead magnets like downloadable checklists, calculators, and cheat sheets. For example, offering a “Year-End Tax Planning Checklist” can help capture email leads. One firm using this tactic saw a 46% increase in leads within 60 days. Use exit-intent pop-ups or gated content to drive conversions.

5. Run Paid Ad Campaigns (Google & LinkedIn)

Paid advertising can supercharge your lead generation by targeting prospects actively searching for your services.

Google Ads are perfect for capturing high-intent leads, those already searching for terms like “VAT accountant for e-commerce businesses”. LinkedIn Ads allow you to hyper-target based on job title, company size, industry, and location, which is ideal for B2B lead generation.

Start small; test multiple offers like free consultations, downloadable resources, or live webinars. One UK firm ran a £600/month Google Ads campaign that booked 18 new discovery calls in just 30 days. The key is ongoing optimisation.

6. Referrals, Networking & Partnerships

While digital marketing is powerful, don’t underestimate traditional networking, especially when it’s systemised.

Build a formal referral programme that incentivises existing clients to recommend your services. Establish strategic partnerships with complementary service providers like web design agencies, legal consultants, or business coaches. These partnerships can become steady sources of referrals.

You can also expand your visibility by speaking at local events, hosting webinars, or joining industry roundtables. Just make sure to follow up with a compelling digital offer like a free resource or strategy call to capture and nurture those leads.

7. Automate Your Follow-Up & Nurturing

Even when you capture leads, many fall through the cracks due to lack of follow-up. Automation solves this problem and ensures no lead is left behind.

Use CRM systems like GoHighLevel to send automated email sequences, SMS reminders, and appointment confirmations. For example:

Send a 7-day nurture email sequence after someone downloads your lead magnet.

Trigger SMS reminders for missed appointments.

Tag and segment leads by interest (e.g., “VAT Help” or “Startup Advisory”) for future campaigns.

This approach not only saves time but also increases conversions by delivering the right message at the right moment.

8. Measuring Success: ROI, CPL, and Conversion Rates

You can't improve what you don’t measure. Tracking performance metrics is essential to refining your lead generation engine.

Focus on:

Cost Per Lead (CPL): A typical target for accountancy firms is £10–£30.

Lead-to-call rate: With an optimised funnel, aim for 30–50%.

Call-to-client rate: Expect 20–30% with a strong value proposition and sales process.

Use tools like Google Analytics, Facebook Pixel, and LinkedIn Insight Tag to gather actionable insights and continually optimise your campaigns.

The average cost per client acquisition (The cost to get a new client) from cold traffic is usually between £400 - £600 depending on your nice. You should use this as an initial benchmark to assess the style of lead generation that would work best for you practice or budget.

Comparing Funnels vs. Websites

A sales funnel represents the full journey from awareness to close, often spanning multiple channels and stages (e.g., Top of Funnel/TOFU for awareness, Middle/MOFU for consideration, Bottom/BOFU for decision). In contrast, a website is typically an inbound tool focused on early-stage conversion (visitor to lead), acting as the entry point to the funnel.

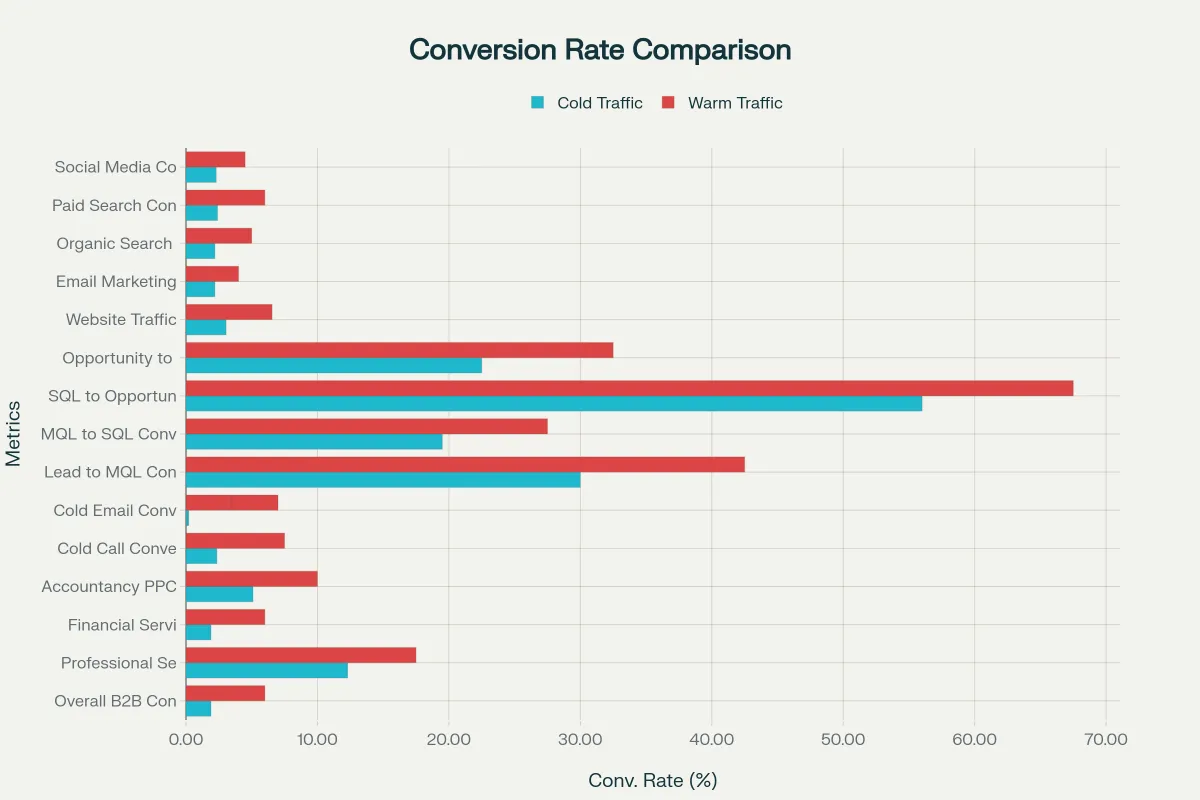

Funnel Performance: Average B2B funnels in professional services convert 25-50% from lead to marketing-qualified lead (MQL), 20-35% from MQL to sales-qualified lead (SQL), and 25-40% from SQL to closed deal. For accountancy, full-funnel efficiency yields 15-30% overall from initial prospect to client for cold traffic, improving to 25-40% for warm. Cold funnels see steep drop-offs (e.g., 70-80% loss at TOFU), while warm funnels retain 60-75% through MOFU.

Website Performance: Websites excel at top-funnel capture but average lower standalone conversions: 2-5% for cold and 5-15% for warm in accountancy. Unlike full funnels, websites rarely handle mid-to-bottom stages without integration (e.g., CRM nurturing), leading to 3-6x fewer closed deals if not paired with outbound follow-up.

Key Comparison: Funnels outperform standalone websites by incorporating nurturing, boosting overall conversion by 2-3x (e.g., a website might generate 30 leads from 1,000 cold visitors, but a full funnel converts 5-10 of those to clients vs. just 1-2 from website alone). Websites are cheaper for inbound scaling but require funnel optimization to match outbound's speed in closing warm leads. For UK firms like those in Rufford, combining SEO-optimized websites with warm outbound (e.g., LinkedIn) yields the best ROI, with reported revenue growth of 5x from integrated approaches.

9. FAQs

Q1: What’s the best platform to generate leads for accountants?

The core three are Facebook, Google Ads and LinkedIn Ads which all work well, depending on your target niche. Google captures active searchers, while LinkedIn is better for targeting specific niches.

Q2: How long until I see results from SEO?

Expect results within 3–6 months. However, content marketing and SEO provide compounding value over time.

Q3: What if I don’t have time for content creation?

You can hire a writer or use AI tools to repurpose existing material such as webinar transcripts, client emails, or internal FAQs.

Q4: Can I generate leads without spending on ads?

Absolutely. Focus on SEO, local directories, partnerships, lead magnets, and consistent email marketing.

Q5: What’s a good benchmark CPL in the UK?

A range of £10–£30 per lead is a solid target, for warm leads, though this varies by niche and offer quality.

10. Key Takeaways

Niche positioning helps you cut through the noise and attract better clients.

Your website should be optimised for both conversions and search visibility.

Combine organic content with paid ads for a balanced strategy.

Automation ensures you follow up consistently and convert more leads.

Track your CPL, conversion rates, and ROI to make informed decisions.

Written by Jamie Carter, Lead Generation Expert @ The Funnelsmiths

https://thefunnelsmiths.com